Plastics machinery shipments up in Q2: SPI

Canadian Plastics

Economy Plastics ProcessesFor the third straight quarter, North American shipments of plastics machinery registered a year-over-year increase in Q2 of 2016, the SPI’s Committee on Equipment Statistics said.

For the third straight quarter, North American shipments of plastics machinery registered a year-over-year increase in Q2 of 2016, according to statistics compiled and reported by the SPI: the Plastics Industry Trade Association’s Committee on Equipment Statistics (CES).

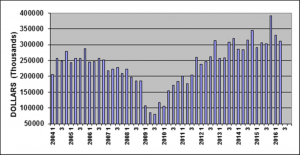

Shipments of primary plastics equipment (injection molding, extrusion, and blow molding equipment) for reporting companies totaled US$312.1 million in the second quarter. This was 2.0 per cent higher than the total of US$306.1 million from Q2 of 2015, but it was 5.6 per cent less than the US$330.5 million from Q1 of 2016. For the year to date, shipments of primary plastics equipment are up 7.6 per cent when compared with the first two quarters of 2015.

“The upward trend in the machinery data continued in the second quarter, but the year-over-year growth rate moderated,” said Bill Wood, of Mountaintop Economics & Research Inc. Wood is the plastics market economist who analyzes and reports on the plastics machinery market for the CES. “The quarterly comparisons will become more difficult in the coming quarters, so the trend of gradual moderation in the growth rate will likely continue. But the incentives to invest in new equipment will persist, so the shipments totals are expected to stay close to the current levels.”

When this data is broken out by reporting sector, there was again a wide variance in the quarterly totals. The shipments value of injection molding machinery escalated 7.3 per cent in Q2 of this year when compared with the total from Q2 of 2015. The shipments value of single-screw extruders increased 12.4 per cent in Q2 when compared with Q2 of 2015. The shipments value of twin-screw extruders (which includes both co-rotating and counter-rotating machines) dropped 35.6 per cent in Q2 when compared with the same quarter last year. The shipments value of blow molding machines decreased 17.3 per cent in Q2 when compared with Q2 of 2015.

New bookings of auxiliary equipment for reporting companies totaled US$123.8 million dollars in Q2 of 2016. This represented a rise of 1.4 per cent over the total from Q2 of 2015, and it was a gain of 3.0 per cent when compared with the total from Q1 of this year.

The long-term, upward trend in the CES data corresponds with the prevailing trends in the two major data series compiled by the U.S. government that measure overall demand for industrial machinery. According to the Bureau of Economic Analysis, business investment in industrial equipment escalated 2.4 per cent (seasonally-adjusted, annualized rate) in Q2 of 2016 when compared with Q2 of 2015. This follows a gain of 3.3 per cent in the first quarter of this year.

According to data compiled by the Census Bureau, the total value for new orders of industrial machinery slipped a bit (<1%) in Q2 of 2016 when compared with the total from Q2 of 2015. This followed a rise of 15.8 per cent in the first quarter of this year.

“Gains in the US GDP were disappointing in the first half of 2016, but economic growth will be closer to the long-term trend in the second half of the year,” Wood commented. “This means consumer demand for plastics products will gradually increase for the foreseeable future. Our outlook for the economy is little changed – annual, real GDP growth will be in the range of 2% due primarily to a slow, but steady improvement in wages and household incomes resulting from stronger employment levels.”

The CES also conducts a quarterly survey of plastics machinery suppliers that asks about present market conditions and expectations for the future. According to the Q2 survey, 77 per cent of respondents expect market conditions to either hold steady or get better during the next 12 months; this is down from 84 per cent in the previous quarter.

The outlook for global market conditions also moderated in the second quarter. Europe has emerged as the region with the strongest expectations for improvement in the coming year. Mexico and North America are expected to be steady-to-better. The outlooks for Asia and Latin America are less optimistic than they were last quarter, but the majority still expects that conditions will hold mostly steady.

As for the major end-markets, the respondents to the Q2 survey expect that medical and packaging will enjoy the strongest growth in demand for plastics products and equipment in the coming year. The expectations for the automotive market are mixed. Expectations for all other end-markets call for steady-to-better demand to prevail in 2016.