Consulting firm Wood Mackenzie discusses coronavirus and the petrochemicals industry

By Patrick Kirby, Wood Mackenzie Principal Analyst, and Matthew Chadwick, Vice President - Global Head of Petrochemicals

Economy Market Forecast Materials COVID-19Two immediate major COVID-19 shockwaves are linked to economic activity and feedstock pricing: a sudden freeze in economic activity, and volatile feedstock pricing following the oil price crash.

The coronavirus outbreak has touched virtually every aspect of modern life. For the petrochemicals industry, the landscape is shifting at an alarming pace. Only one thing seems certain: the coming decade will be shaped by this crisis. Consumer behaviour, investment decisions, the corporate landscape and even the path of globalisation will be influenced by its effects.

Two immediate major shockwaves are linked to economic activity and feedstock pricing.

Shockwave 1: a sudden freeze in economic activity

The global economy is heading for recession. Our thinking has moved from an economic slowdown to a deep global recession, with the potential for a slow recovery. This has dramatic implications for the industry.

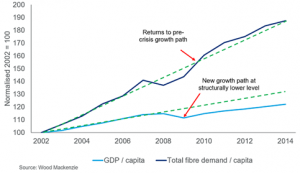

The lockdown measures in place around the world are unprecedented in modern history. The one playbook the industry has to go by is the 2008/2009 global economic crisis, when chemical demand growth recovered rapidly following a sharp dip in global economic activity. That recovery was supported by global stimulus packages, particularly from China. To date, similar measures in this crisis have provided less momentum or reassurance.

Normalized world GDP/capita versus total fibre consumption/capita

Before the coronavirus outbreak, we had two underpinning base case views for petrochemical demand.

- Long-term demand growth for petrochemicals is robust. Feedstocks are one of the fastest-growing parts of the oil barrel, so oil-related companies continue investing.

- Plastics circularity will grow in scope and scale to become an increasingly integral part of the industry. Chemical companies are increasingly active in the space.

Longer term, we expect these trends to remain. However, the crisis will slow investment and shift focus towards cash reservation and capex discipline. The evolution of plastics circularity is also likely to slip down the pecking order. Meanwhile, a low oil price makes recycling economics tougher.

The impact will differ across chemical value chains and end-use segments. Packaging, sanitary and medical polymer applications are seeing a short-term lift. This is due to stockpiling, a boom in delivery services and the high healthcare sector activity. Other major polymer-consuming sectors, including automotive and construction, have taken a hard hit.

Shockwave 2: volatile feedstock pricing following the oil price crash

Crude oil prices have crashed, past the lows of the 2008 recession down to around US$20-25/bbl. Weak global economic prospects, coupled with high oil supply, are expected to keep prices low in the near term.

Refined product prices have followed crude, amplified by the sharp drop in mobility and transportation fuel consumption. As a key connection to base olefins and aromatics manufacturers, refining industry trends can dramatically disrupt petrochemicals unit operations down multiple value chains.

Short-term NGL supplies (the second key energy-linked feedstock) are more robust than refinery supplies. But North American upstream investment cuts will directly affect petrochemical buyers in the medium term. Assets with the most feedstock flexibility will be best positioned.

The tumbling oil price has reshaped the combined cost base of the global petrochemical industry. This is demonstrated clearly in the largest petrochemical: ethylene. Global competitiveness and profitability for the world’s major producing locations changed virtually overnight.

In the medium term, new petrochemical capacity additions are likely to be lower – good news for an industry entering crisis. Existing projects under construction will be postponed by labour restrictions and decision-making on pre-FID projects will slip, perhaps indefinitely. Frustratingly, in the short term, labour restrictions are also delaying planned maintenance, meaning more supply will stay online. But this could be countered in the coming weeks by difficulties in recovering from unplanned interruptions.

How will the chemicals industry respond to the crisis?

Polymer consumption patterns are in disarray. Plunging oil prices are hitting feedstock pricing and profitability. The industry – like so many others – faces significant uncertainty. So, what’s the likely response?

Right now, the focus is mainly on the human aspects of the crisis, in addition to managing immediate operational disruption. But crisis management only extends so far. The industry must ask itself how to set up for success in a decade that looks very different to the last.