Demand from packaging and healthcare segments to help polyolefins market stay afloat amid COVID-19, report says

Canadian Plastics

Automotive Economy Market Forecast Materials COVID-19The global polyolefins market is expected to decline in 2020 due to weaker end-market demand, analytics firm GlobalData says, but there will be strong gains in these other sectors.

The global polyolefins market is expected to decline in 2020 due to weaker end-market demand from applications such as construction, automotive and industrial, a new report from market research and analytics firm GlobalData says – but the pandemic-driven feeble demand is partially offset by strong and increased demand from sectors such as packaging, fast-moving consumer goods (FMCG), and healthcare.

“The global auto industry is facing a pandemic-led sales decline of 16-17 per cent this year,” said David Leggett, automotive analyst at GlobalData, which is headquartered in London. “That translates to much lower demand for materials such as polyolefins in automotive manufacturing. Although the global vehicle market is in recovery phase, the outlook for sales remains uncertain while the pandemic and its adverse economic impacts, persists. The underlying level of demand is not forecast to recover to pre-pandemic levels until 2023”.

While some industries are struggling, meanwhile, the strong gains of polyolefin use within FMCG and packaging may be due to consumer behavior. “The COVID-19 pandemic has led many consumers to report being more cautious when buying food and FMCG products,” said Carmen Bryan, consumer analyst at GlobalData. “Many have reverted to more traditional packaging materials such as PET, despite ongoing environmental concerns, as these are perceived as safer and more hygienic. In fact, 53 per cent of respondents to GlobalData’s survey in June noted that they are concerned about the safety of product packaging amid the pandemic – a concern that has remained relatively stable over the past few months, standing at 50 per cent as of the October survey. This suggests the emergence of a new trend as single-use plastics that securely seal food and beverages return to popularity.”

And with the gradual appreciation of economic activity, the report continued, the demand for polyethylene and polypropylene is likely to improve towards the end of 2020 and maintain the upward momentum from 2021. “The pandemic has impacted the demand for polyethylene and polypropylene in the shorter term,” the report said. “Consequently, polyolefin producers have either lowered operating rates, halted operations or declared force majeure to withstand the challenging economic conditions. Petrochemical companies are closely monitoring economic developments and would undertake a strategic review of the progress and development of key projects.”

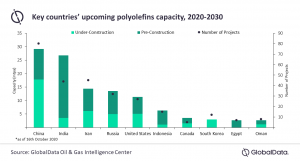

In response to the economic impact of COVID-19 on sectors worldwide, major petrochemical companies have preferred deferring final investment decisions (FIDs) or delaying project execution wherever possible. “For instance, FIDs of PT Chandra Asri Perkasa Cilegon Polyolefin projects have been postponed from 2021 to 2022, while the PTT Global Chemical Belmont County project has been postponed to Q1 2021 from the initially planned 2020,” the report said. “Although prospects for additional FIDs in the sector look challenging, companies look to focus on key projects and ensure the completion of these projects on priority.”

Polyolefin capacity additions are largely concentrated in Asia – primarily China and India – that target self-sufficiency to meet the existing and growing demand in their respective countries. Other majors such as Russia, Iran and the U.S. also have a significant capacity addition, GlobalData noted.